Detailed description of taxes on corporate income in Malaysia. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come.

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

According to the EIS contribution table 02 will be paid by the employer and 02 will be cut from the employees monthly wages.

. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. It provides internationally comparative data on global trends in tax administrations across 58 advanced and emerging economies.

Non-residents are liable to income tax only on Portuguese-source income which includes not only that portion of remuneration that can be allocated to the activity carried out in Portugal but also remuneration that is borne by a. Tax exemption for individuals earning less than P250000. Melayu Malay 简体中文 Chinese Simplified Malaysia Audit Fees Schedule and Table.

The report is intended to inform and inspire tax administrations as they consider their future operations as well as to provide information on global tax administration. Chargeable income MYR CIT rate for year of assessment 20212022. But the process of implementing the new tax regime commenced a long time ago.

According to the Global Competitiveness Report 2021 the Malaysian economy is the 25th most competitive country economy in the world. Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when.

If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied. Is imposed on income accruing in or derived from Malaysia. An individual earning less than P250000 a year is exempted from withholding tax where the income is coming only from a single payor ie.

Malaysia Institute of Accountants MIA has recommended Practice Guide RPG 7 for Audit Fee Charge New Audit Fee by Audit Firm for providing statutory auditing services in Malaysia with effect from 1 March 2010. Resident company other than company described below 24. Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 145 to 48 for 2022.

This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital. The 2018 labour productivity of Malaysia was measured at Int55360 per worker the third highest in ASEAN. On July 1st 2017 the Goods and Services Tax implemented in India.

The economy of Malaysia is the third largest in Southeast Asia and the 34th largest in the world in terms of GDP. Type of company. A tax withholding agent.

Private-sector employers are. This report is the tenth edition of the OECDs Tax Administration Series. Improving Lives Through Smart Tax Policy.

Sales and Service Tax SST in Malaysia. Calculations RM Rate TaxRM A. The current CIT rates are provided in the following table.

This full version contains the full text of the Model Tax Convention as it read on 21 November 2017 including the Articles Commentaries non-member economies positions the Recommendation of the OECD Council the historical notes and the. This post is also available in. On the First 5000.

On the First 5000 Next 15000. According to EIS contribution table contribution rates are specified in the second annex and are governed by the rules of section 18 of the Employment Insurance System EIS Act 2017. In 2004 a task force concluded that the new tax structure should put in place to enhance the tax regime at the.

In 2000 Atal Bihari Vajpayee then Prime Minister of India set up a committee to draft the GST law.

World S Highest Effective Personal Tax Rates

2017 Tax Bracket Rates Bankrate Com

到底几时要报税 2017年 Income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Egypt Tax Revenue Of Gdp 2005 2022 Ceic Data

.jpg)

Financing And Leases Tax Treatment Acca Global

Doing Business In The United States Federal Tax Issues Pwc

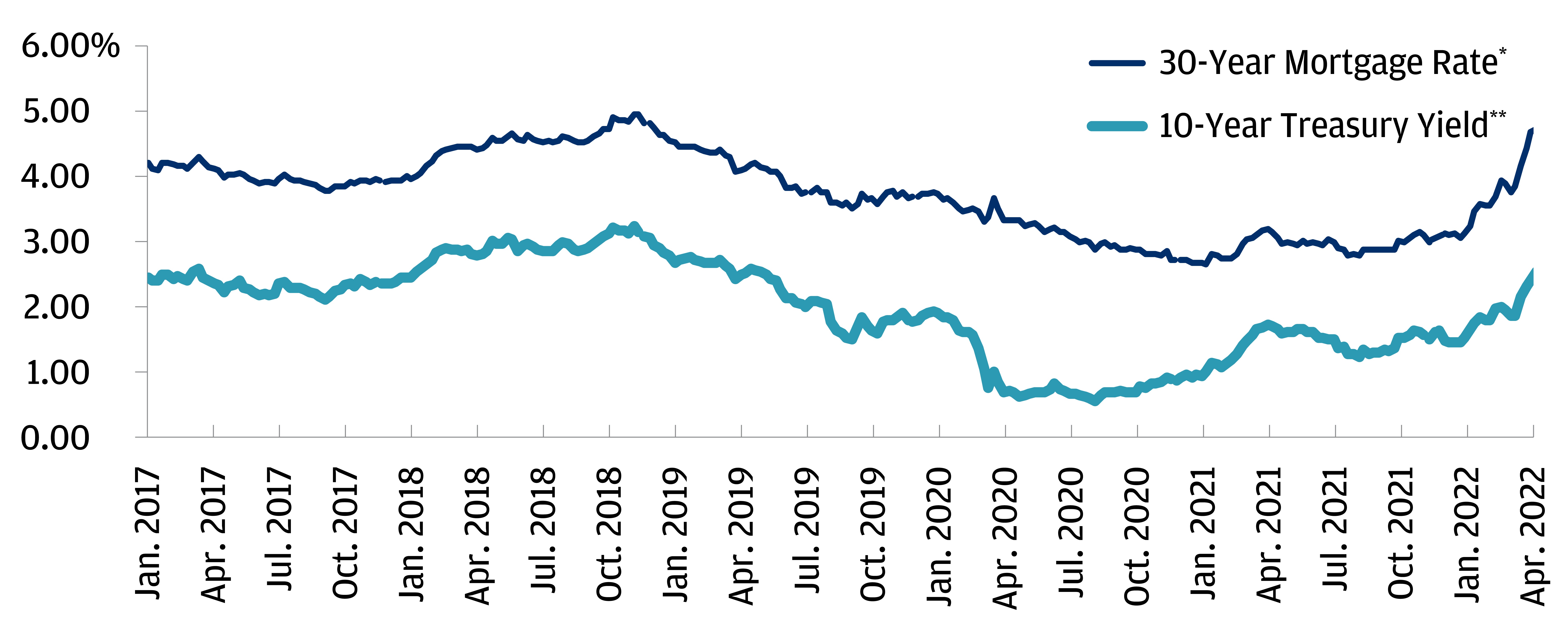

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

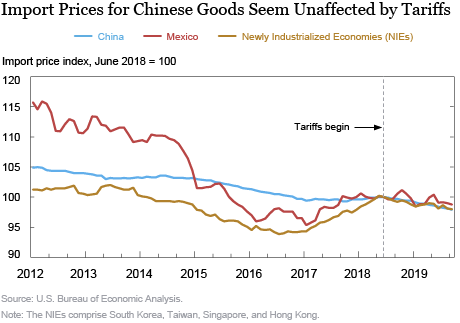

Who Pays The Tax On Imports From China Liberty Street Economics

Malaysia Payroll And Tax Activpayroll

What Influences Tax Rates In Sub Saharan Africa Center For Global Development Ideas To Action

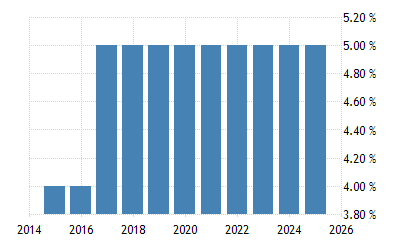

New Zealand Tax Revenue 1999 2022 Ceic Data

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Corporation Tax Europe 2021 Statista

Individual Income Tax In Malaysia For Expatriates

Chile Tax Revenue 1990 2022 Ceic Data

Malaysian Tax Issues For Expats Activpayroll